This is the weekly analysis of Merger Arbitrage Spread Performance December 8, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 2nd – 6th December. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 1st December. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance December 8, 2019

Changyou.com (CYOU)

Changeyou.com continues its volatile run and remains as one of the top movers this week settling in the winners enclosure. The stock closed the week at $9.73 up 1.88%. There has been little deal news since the recent earnings announcement. However, we previously suggested the potential viability of using our active arbitrage strategy on this deal. This involves actively buying and selling the stock to take advantage of the volatility of deal closing probability (DCP). We initially took an average sized position late on Monday and exited the position during the middle of the week. We shall continue in this manner for the foreseeable future.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers retained is place amongst the largest movers this week and continued its upward momentum. Without any new deal news in the popular press the stock continued its recovery by an additional $0.46 to close at $27.73. This leaves the simple spread at 44.25%. Ironically, we suspect the recent earnings disappointment is the impetus for this buying. Should the poor performance continue management may be forced into negotiating a sale of the company. We continue to hold our position at least until further news is available.

Fitbit (FIT)

Fitbit also continues its volatile run. The stock was slowly declining through the week and saw that decline accelerate following a report on its potential acquirer Google (GOOG). The Competition and Markets Authority (CMA) announced on Thursday that it had issued an initial enforcement order regarding the $2.6 billion takeover of Looker Data Sciences. This prevents companies integrating their businesses whilst the regulator carries out a early-stage review of the acquisition. We previously wrote extensively on the merits of this deal as a potential merger arbitrage investment opportunity. This action by the CMA now confirms our analysis. Google, amongst other tech giants has been described as a “robot vacuum cleaner” in the way that it collects information about its users to give it a competitive edge. Margrethe Vestager, the European Union’s Competition Commissioner, who coined this description, is currently looking into how companies such as Google collect and use this information.

Undoubtedly this has caused the FIT spread to widen. Although the Looker deal was cleared by U.S. regulators last month this commencement of an investigation by the CMA increases the possibility that U.S. regulators may decide to investigate the Fitbit acquisition. Should this be the case, the expected completion date could be pushed back by three months or even longer. We believe this deal would still close successfully however as it would be natural to assume Google has been at least half expecting some sort of investigation and thus prepared accordingly. If this wasn’t already the case it would be natural to assume they are readying their defenses now in anticipation of regulatory hurdles.

This increased possibility of an extended completion timeframe causes the simple spread to widen immediately. The longer timeframe is then offset by the larger simple spread so the annualized spread level remains constant. The stock closed on Friday to finish the week at $6.74 down $0.22. This gives a simple spread 9.05%. Our initial in depth analysis of this deal was when FIT was trading above $7. Despite a 4-5% decline since then we still don’t see this as an attractive arbitrage play… yet. Until a more serene regulatory landscape is observed we shall remain on the sidelines. However, for those that are brave enough a further $0.06 drop would give a spread of 10%. The official expected closing is currently given as “expect the Merger to be completed in 2020″. Were this deal to take a year to close (the “end date is give as November 1, 2020) then a 10% annualized return may soon be a very real possibility.

Pacific Biosciences of California (PACB)

PACB was again amongst the largest movers this week. Despite climbing higher on Monday, Tuesday saw the start of a decline that continued all week with the stock ending of exactly $5.00, down $0.14 or 2.72%. Tuesday saw the release of a 49 page document detailing the “Parties’ Response to Provisional Findings – Illumina / Pacbio response to provisional findings”. However, the market appears less than impressed. This latest decline still leaves a spread of 60.00%. We will maintain our holding pending further news and look forward to continuing our active arbitrage strategy.

Merger Arbitrage Portfolio Performance

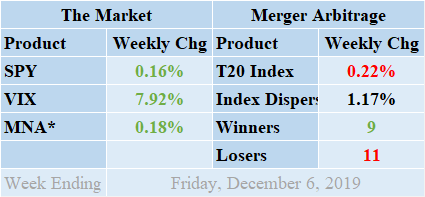

Winners and losers were almost evenly matched this week with the losers just edging it by 11 to 9 with 0 non-movers. The portfolio remains fully stocked with a complement of 20 cash merger arbitrage and 0 cash positions. The portfolio failed to continue its positive run this week and finished in negative territory down by 0.22%. This week’s fall was primarily attributable to the decline in FIT & PACB, although CYOU did provide a impressive positive return. Additional live news updates for these deals can be found on our customized T20 Index news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers in our spread tracker and which we consider eligible for investment and trading. For even more specific merger details & news see also the dedicated news and merger information pages on deals such as CISN, FIT, GWR, KEM, ONCE, PEGI, RARX, TIF, WMGI, & ZAYO. The standard deviation of individual returns for the past week was 1.17%. This figure is significantly below both the short-term and long-term averages.

MNA SPY VIX Returns Table 20191206

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, again just managed to finish in positive territory following what was shaping up to be a strong week. A steep decline on Thursday required a recovery on Friday to put the ETF back into positive territory. MNA finished in the black to the tune of 0.18%. This continues a positive run extending back for an impressive 9 weeks. The broader market produced a much a similar return over the same period. However, the route taken was much more docile as the market ambled its way through the week. Improving domestic employment data such as payrolls and rising wages helped reinforce sentiment regarding a strengthening economy. The SPDR S&P 500 ETF, SPY, finished up 0.16%. Surprisingly however the VIX index also moved higher over the same period. By Friday, the index had risen by 7.92%.

Although traders still remain hopeful of some kind as a trade deal between the U.S. and China, or at least some kind of agreement there is still no sign as to when this may occur. Encouraging economic data at home and abroad is helping underpin the markets but the VIX, also known as the “fear index” still indicates the underlying caution in the market place. We expect this state of affairs to continue but as always remain poised to spring into action when required.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.