This is the analysis of Merger Arbitrage Spread Performance September 1, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 26th – 30th August. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 25th August. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance September 1, 2019

Cambrex (CBM)

Cambrex made a surprise move to the top of the leader board this week. The stock gained 1.13% to close at $59.93. With only $0.07 left in the spread, the stock has now fallen out of the T20 portfolio. Friday saw the largest rise accompanied by slightly higher than average volume. Although little news was available, we suspect this deal will close in the near future.

El Paso Electric (EE)

El Paso Electric (EE) was the second largest gainer this week and rose 0.98% to $66.70. For the second time in a few week’s customers set a new peak demand for electricity. Good news such as this helps underpin the floor price in the event of a deal break. We spoke previous about this spread. The additional regulatory issues concerning a utility stock lead to an extended closing timeline, in this case the middle of next year. With early closing, the annualized spread is an investment possibility, however we shall continue to review and bide our time.

WABCO Holdings (WBC)

WABCO was the other gainer of note this week. This competes a rare trio of less volatile stocks filling the top three places. WBC gained 0.82% to $133.51. What made this rise important for us is that we top a position early on in the week at $132.50. We took a small position in anticipation of the DOJ review. A suspect early closing in this deal may provide a profitable opportunity. The stock may also have benefitted from a slowdown in the drop of Chinese auto sales.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) continued its rollercoaster ride this week. The stock finished down $1.41 or 4.04% at $33.49. This leaves a spread of $6.51 against a buyout price of $40. On Tuesday, Bank of America Merrill Lynch lowered their rating to underperform from neutral. This sent the stock down over 2% although there was no mention of the proposed takeover was made. Investors are clearly concerned about the future of the company if it remains in the public domain. One would assume this negativity surrounding the business outlook might spur RRGB management into active dialogue with Vintage Capital. Investors may of course be remembering the shareholder rights plan (poison pill) adopted on June 5.

Spark Therapeutics (ONCE)

Spark Therapeutics had a terrible week hitting new lows since the takeover announcement. The stock closed down another 3.35% at $97.41. Other than announcing a change of venue for the AGM, there was no other news. However, the tender offer is expected to close September 3. We expect an extension to be made to this deadline and have already extended it arbitrarily by one month in the spread tracker. We shall adjust this figure once more details are available. Once again, we will be waiting for a decision from the regulatory authorities regarding this deal. We maintain our position.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) is never far from the action. The stock was the third worst performer this week. It finished down 1.07% at $5.55. There was no new deal news announced although there was “General statement of acquisition of beneficial ownership” filing. The current volatility of this stock would be playing well into our previous active arbitrage strategy. However, we have enforced strictly discipline in this instance. We maintain our long position.

Merge Arbitrage Portfolio Performance

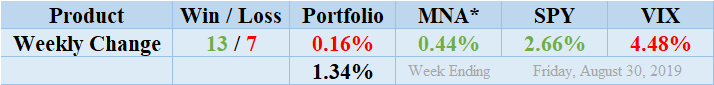

Winners beat out the losers by a score of 13 to 7 with 0 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. However, the portfolio showed a negative performance finishing down for the week by 0.16%. As discussed above, despite the quantity of gains, large declines from a small number of spreads (namely RRGB again) was sufficient to keep the index in negative territory. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 1.34% reflecting in large part the smaller movements made by the winning spreads. This figure is lower than both the long-term and short-term averages.

MNA SPY VIX Returns Table 20190830

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

Gains throughout the week left the MNA ETF producing an overall gain and was left showing a healthy positive return of 0.44%. Could this be the week when the IQ Index merger arbitrage ETF begins to gain some traction and embark on a positive run? The broader market however continues to experience heightened volatility. The S&P 500 ETF, SPY, finished up by 2.66%. The VIX index accordingly moved lower and eventually settled on a decrease 4.48% for the week. We had previously suggested volatility would remain higher as we exit earnings season and continues speculating on the next action in the ongoing trade war. This continues to be the case, however this weeks has seen spreads suffer in a rising market.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.