This is the analysis of Merger Arbitrage Spread Performance July 21, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 15th – 19th July. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 14th July. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance July 21, 2019

Acacia Communications (ACIA)

Acacia Communications (ACIA) was the best performer this week despite only increasing in price by 0.54%. The $0.35 increase leaves the spread at $5.25 or 8.11%. However, the expected closure date for this deal is given as the end of May next year. During the week, it was announced that Viasat won $49.3m in its intellectual property suit against Acacia although this had little effect on the stock price. A filing by the company during the week also spelled out the benefits of the proposed takeover by Cisco. We suspect the expected closing timeline to be overly generous. We will be looking to take a position in the stock in the very near future.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continued its downward trend during the week. We now have an explanation for last week’s sell off. The stock tumbled this week by 10.27%. On news that the

“Final report from the UK Competition & Markets Authority (CMA) … concluded that their planned tie-up will lessen competition”

It was interesting to see the stock move by more than 10% before any official news announcement hit the market. Anyway, obviously this drop has hurt profitability considerably. Our strategy welcomes the increased volatility but we were surprised by the size of the drop following previous announcements on the issue.

In the meantime, any further negative news will probably result in a deal failure/abandonment. We have calculated a floor price of around $4.60 should the deal break that will of course be further effected by any additional selling by the presence and exiting of the arbs. For this reason, we do not see any need to add to our position until further guidance is released.

CIRCOR International (CIR)

The second major blow to merger arbitrage profitability this week came in the form of CIRCOR International. The stock declined 8.46% for the week on news that CRANE will not pursue the offer any further beyond the expiration of the tender offer on Friday night. This comes as a response from the CIRCOR board that the offer is insufficient and the refusal to engage in dialogue. The news initially sent the stock down towards $36 but recovered partly during the rest of the week. On Thursday, traders welcomed an announcement from the company that it is to sell its upstream oil & gas engineered valve business and focus on core activities as previously stated. However, also on Thursday an announcement by GAMCO stated their intention to tender Circor their shares. This helped boost the stock price through Friday as some arbs speculated on the success of the tender offer. As the price remained below $39 against a tender price of $48 this is obviously a speculative position. At the time of writing, the outcome of the tender offer is unknown. Although either way the deal is seen as finished. We shall report any further news via out twitter feed.

Spark Therapeutics (ONCE)

Spark Therapeutics was the third largest decliner this week losing 1.22% to $96.85. There was no mainstream news for this decline and it compounds a series of weekly declines. The decline this week is in keeping with the broader market sell off. Without further news available, we maintain our small position.

Cypress Semiconductor (CY)

Cypress semiconductor was another significant decliner during the week losing 0.93% at $22.28. The spread is now offering 8.03%. The widening of the spread during the week is despite positive deal news and further deal clarification. On Monday, Bank of America stated how CY could drive 50%+ Infineon upside following a successful takeover. The news obviously reassured arbs of the necessity for the deal to succeed.

On Tuesday, the company filed a Schedule 14A stating the special meeting for the stockholders vote will be held on August 27th. Then on Thursday, the company also announced the withdrawal and refiling under the HSR premerger program. We assume this news was taken in a negative light as investors mused the possibility of HSR complications. However, the size of this spread is still attractive even when compared to the expected closing date of January 31, 2020. We maintain our position.

Portfolio Performance

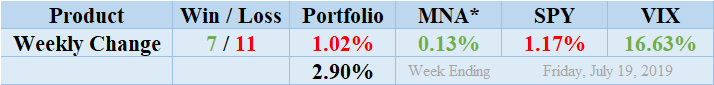

Losers beat out the winners by a score of 11 to 7 with 2 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a significantly negative performance finishing down for the week by 1.02%. As discussed above, the vast majority of this loss is attributable to the decline of CIR & PACB. Readers can also stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 2.90%. This is significantly higher than last week and is the highest number ever recorded.

MNA SPY VIX Returns Table 20190719

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF outperformed the broader market producing a slightly positive return of 0.13%. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Following Friday’s loss, the S&P 500 ETF, SPY, which flirted with new highs at the start of the week finished down by 1.17%. The VIX index accordingly increased during the week by 16.63%. We now expect volatility to continue at current level following the geo-political tensions in the Gulf. Stock specific volatility and market direction going forward will be governed by earnings season announcements.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.