This is the analysis of Merger Arbitrage Spread Performance July 14, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 8th – 12th July. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 7th July. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance July 14, 2019

Redhat (RHT)

Redhat was the biggest gainer this as the deal closed in a somewhat unexpected manner. Regulatory permissions were granted, rescinded and granted yet again but nonetheless the deal closed at the $190 original offer price. The original expected completion date given by IBM suggested the end of the year. However, as we have said many times, an accurate prediction of deal closing can seriously improve profitability. Capital can now be reinvested sooner and help produce an extremely attractive annualised return. It should be noted of course that it is doubtful that even the most optimistic IBM supporter would have thought the deal would have closed this early.

Zayo (ZAYO)

Zayo also performed well during the week and finished up 0.93%. There was little deal news surrounding the rise although an investigation by Andrews & Springer has concluded the amount offered is considered “inadequate”. We believe this spread continues to offer good value and we are happy to maintain our position for the time being.

Cypress Semiconductor (CY)

Cypress semiconductor continues its dark horse status within the portfolio. Last week it was the third best performer and again finished up 0.81% at $22.49. The spread is still offering 7.03%. Despite little news during the week, we are happy to maintain our position. As mentioned previously, this is another semiconductor stock that may fluctuate on the whims of the US-China trade talks. However, we are looking for early closing for this investment to be worthwhile. Currently, official expected closing is early in the new year.

Spark Therapeutics (ONCE)

Spark Therapeutics was the largest decliner this week losing 4.87% to $98.05. There was no mainstream news for this decline and it compounds last week’s drop. Previously a simultaneous investigation by the FTC and the CMA (again) have caused investors to look again at the potential downside of the deal. The stock was trading at around $50 a share before and deal talk began. However, we maintain our small position until further news is available.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continued its downward trend during the week. Traders are continuing to react negatively to the news that the company will not be offering any undertakings that would prevent or delay the referral of the deal to a phase 2 investigation in the UK. The stock closed at $5.94 but still down 2.78% for the week, making it the second largest decliner from the Top20 cash spreads.

We initially expected little stock price movement and forecasted news flow to be scant. However this additional drop has provided us with another opportunity to pick up some cheaper stock as we stated previously. Further out, we expect volatility to increase and assist our active arbitrage strategy and continue trading as before.

Portfolio Performance

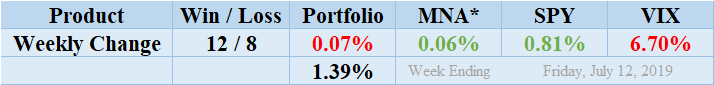

Losers beat out the winners by a score of 12 to 8 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a mildly negative performance finishing down for the week by 0.07%. As discussed above, the vast majority of this loss is attributable to the decline of ONCE & PACB. Readers can stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 1.39%. This is significantly higher than last week but in line with both the recent and longer-term averages.

MNA SPY VIX Returns Table 20190712

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF underperformed the broader market producing a slightly positive return of 0.06%. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Following Friday’s gains, the S&P 500 ETF, SPY, which fluctuated during the week finished up by 0.81%. The VIX index also decreased during the week by 6.70%. As stated last week, we continue to expect volatility to subside somewhat following any advances in the trade talks between the USA and China.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.