This is the analysis of Merger Arbitrage Spread Performance July 7, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 1st – 5th July. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 30th June. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance July 7, 2019

Mellanox (MLNX)

This week’s strongest performer was Mellanox (MLNX), which finished the week up 1.35%. As is a common theme this week, there was little news to report. Spread movements have been widely influenced by broader market movements caused by increased bullish sentiment regard the domestic economic situation. MNLX however was one of last weeks biggest losers and the volatility in this stock makes it a prime target to benefit heavily from broader market movements.

Array BioPharma (ARRY)

Array Biopharma (AARY) was the second biggest gainer this week up 1.17%. This is a tender offer, which is scheduled to close July 26. Two filings were made during the week detailing amendments to the tender offer. The spread is currently offering 2.41%. On an annualized basis, this is an impressive return which suggests the market may not be expecting a successful initial offer. We are looking to take a small speculative position in this deal during the coming week.

El Paso Electric (EE)

El Paso Electric (EE) makes a rare entry into the biggest movers category this week as the stock moves up 1.16%. The simple spread is still offering 4.91%. However, expected closing is not until the middle of next year. With early closing, the annualised spread is an investment possibility. In the meantime “Native El Pasoan Adrian Rodriguez Named Interim CEO of El Paso Electric”. There was no mention of the pending takeover from Infrastructure Investments Fund made during this announcement.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) was also amongst the winners this week. The stock closed up 0.99% at $6.11. This continues the recovery from the recent low $5.80’s. This is due to the clarification of the deal being elevated to a phase 2 investigation by the CMA. We have added to our position during the week and following our earlier analysis of awaiting further deal clarification, we continue our active arbitrage strategy. Following any further rise in the coming week(s) we will be looking to exit part of this position.

Aquantia (AQ)

Aquantia (AQ) was up 0.92% for the week. During the week, a filing by Kahn Swick & Foti was made suggesting the company has been undervalued. We have no position in this stock but will keep you informed of any developments via out Twitter feed.

WABCO Holdings (WBC)

WABCO Holding (WBC) was the only decliner of significance this week. There was no news and we mention the decline solely for the sake of completeness. The stock finished down by 0.40%. This deal currently offers 3.35% and we continue to hold our position.

Portfolio Performance

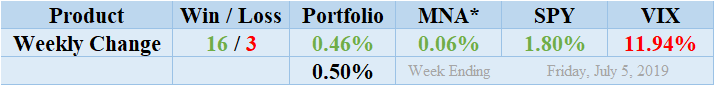

Losers beat out the winners by a score of 16 to 3 with 1 non-mover. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance finishing up for the week by 0.46%. As discussed above, the majority of this gain was spread across the portfolio. Investors cheered the global economic situation as prices rose across all markets. Readers can stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 0.50%. This is significantly lower than last week but in line with both the recent and longer-term averages.

MNA SPY VIX Returns Table 20190705

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF underperformed the broader market producing a positive return of just 0.06%. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Despite Friday’s loss, the S&P 500 ETF, SPY, finished up by 1.80%. The VIX index subsequently decreased during the week by 11.94%. Volatility continues to subside as we expected following the trade talk between the USA and China. We expect this situation to continue but stand ready for any reversal in their progress.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.