This is the analysis of Merger Arbitrage Spread Performance February 24, 2019. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 19th – 22nd February. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 17th February.

Winners

- This week’s best performer was again Pacific Biosciences of California (PACB). The stock climbed a staggering 3.37% for the week and the spread now stands at 8.55%. This stock has provided a great return for investors who were brave enough to dive in at the lows of $6.80. We have been trading the volatility of this spread and although we have not made the same return as the long only position we are still happy with our performance. We are now almost out of our position but will look to increase on a pull back.

- NxStage Medical (NXTM) increased 2.39% to $30.00 as early regulatory approval signalled the completion of the deal. We warned last week the completion date might be hard to forecast and was the reason for the spread being as wide as it was at the start of the week. Those traders who were confident of regulatory approval have enjoyed a great return in the last two weeks. The FTC commission was split however with two dissenters arguing that the deal will be harmful to the consumer.

- Redhat (RHT) had another strong week and finished up 1.02%. It appears a matter of regularity nowadays that RHT will increase by almost 1% each week. The stock is now at $182.83 and the spread has now reduced to 3.92%. With very little news during the shortened trading week the only regulatory filings were regarding changes of ownership. As cash deals with larger spreads become increasingly difficult to find investors are looking towards RHT especially following the endorsement given by Berkshires Hathaway’s investment. Although we still maintain our long position and have stated we were happy to do so in light of last weeks investment, the continued rise leaves us very close to taking some money off the table. Should this be the case, we will be ready to jump back in should the opportunity arise especially if the market undergoes a broader pullback.

- InfraREIT, Inc. (HIFR) was the other gainer of note this week up 0.85%. Again there was no official news regarding the takeover. This stock moved up $0.18 during the week and now trades above the offer price even when dividends are included. At $21.32, there is a $0.25 dividend to be paid which leaves the spread at a $0.07 premium. This is not the first time the stock has traded at this level. Previous, arbitrageurs were burnt when speculating on a higher offer for the stock and the prices returned to a more traditional spread level. However, speculation and chatter is expected to increase in the coming week as traders try to fathom out why the stock is at a premium once again. We will keep you updated via our twitter account as soon as we see any significant news.

Losers

- This week’s worst performer was Tribune Media Company (TRCO). The stock declined 0.50% or $0.23. Much of the talk this week centered on the announcement that earnings will be on March 7th but the drop occurred on Friday. With no news forthcoming this could be a signal that something significant is about to happen or possibly an announcement regarding Nexstar (NXST) sale of various local television stations to satisfy regulatory approvals. This spread was at 1.20% at the start of the week and now stands at 1.73% if two dividend payments are included.

Portfolio Performance

We’ve previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

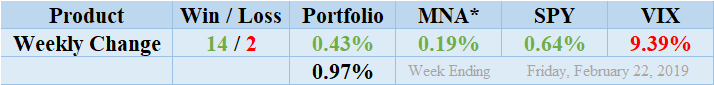

Winners continued to dominate losers this week winning by a margin of 14 to 2 with 4 non-mover and 3 cash positions due to lack of eligible candidates. The portfolio showed a mightily impressive positive performance of 0.43% due mainly to the closed deal of NXTM mentioned above and PACB. The standard deviation of the returns is 0.97%. This is greater the average level and again reflects the variation of returns caused by the aforementioned deals. PACB continues to be the primary instigator of portfolio deviation although TRCO negative performance was also a contributing factor. There were no dividends paid during the week from the T20 list. The MNA ETF returned a positive territory improving 0.19%. The S&P 500 ETF, SPY also put up a positive 0.64% for the week. Unsurprisingly, following the fourth week of rises for the broader market and continuing ambivalence towards the on-going US-China trade tensions the VIX index declined by 9.39%.

MNA SPY VIX Returns Table 20190222

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.