This is the analysis of Merger Arbitrage Spread Performance January 27, 2019. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 21st – 25th January. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 20th January.

We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

- This week’s best performer was Arris International (ARRS) gaining 0.94%. Despite little merger news analysts now expect EPS to be $0.76 on February 13 as opposed to $0.81 previously. The refiled HSR waiting period expires on January 30th and it is assumed traders are taking their positions now. The spread is still at 2.09% and as previously stated by the company remains on track to close in 1H. An early closing to this deal could provide a handsome return to investors on an annualised basis. We maintain our long position.

- This week’s 2nd best performer was Integrated Device Technology Inc (IDTI) up 0.62%. Analysts expect IDTI to report $0.37 EPS on February, 4th, unchanged from previous estimates. Hopes of an end to the Government shutdown sufficient to help clear the CFIUS backlog has helped the stock this week. As noted last week, “antitrust approvals have already been received from a variety of global agencies in addition to the expiration of the HSR waiting period. But the CFUIS delay is sufficient to cause the spread to widen as forecasting a completion date becomes more treacherous.” We no longer have a position in this stock but are monitoring the situation closely and ready to re-enter at any time.

- Redhat (RHT) had yet another volatile week and finished in positive territory up 0.56%. If this rise continues at this pace we will be looking to take some money off the table and redeploy the capital elsewhere. The extended time frame of expected completion for this deal, even if it were to close early does not warrant keeping a full position.

- Another gainer was TransMontaigne Partners (TLP) up 0.36%, due to be acquired by ArcLight Energy Partners at $41. It is important to reiterate that dividends will continue to be paid during the process of this deal. Hence the stock trading at a premium to the offer price. The company announced during the week that it will hold a “special meeting of its unitholders, on February 26, 2019” to vote on the deal.

Losers

- This week’s worst performer was Pacific Biosciences of California (PACB). The stock declined 2.32%, $0.17 this week following last weeks rebound. During the past week two filings were made. Form S-8 showing detailing information on the issuance of new shares as part of than employee benefit plan. But more importantly was the 8-K showing the results of the special shareholder meeting held on the 24th January. As expected, shareholders voted overwhelmingly to accept the offer from Illumina, Inc. and FC Ops Corp. The market was less than impressed and punished the stock as the delay caused by a second request for information combined with the government shutdown adds to the uncertainty regarding the anticipated closing date. The stock is still offering a return of 11.58%.

- Aspen Insurance Holdings (AHL) was the week’s second biggest loser. The company announced on Thursday that 4Q results will be released after market close on February 6th. However of greater note was the increased put buying on Friday. The stock was down 0.97% but still only offers a spread of 2.13% for a deal which is expected to close in the middle of the year.

- Essendant Inc (ESND) was also down again 0.87%. This week’s decline follows last week’s negative performance. Once again we saw the company file an extension of the tender offer for an additional week. The acceptance level has now climbed to 73.4% of the outstanding shares. Having fulfilled the acceptance level requirement, the companies continue to await fulfilment of the HSR clearance condition. Staples and Essendant still “expect the merger to close in early 2019”. At $12.48 a share, this simple spread is still offering 2.56%.

- The final loser of note this week was Avista Corp. (AVA) who along with acquirer HydroOne finally officially called off the planned merger on Wednesday following the recent orders by state regulators in Washington and Idaho which denied approval of the merger. AVA is now due to receive a $103m termination fee. This stock has now drops out of the official T20 list and will no longer be covered.

Portfolio Performance

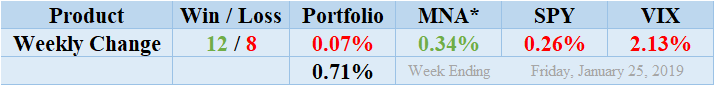

Winners continued to outpace losers this week winning by a margin of 12 to 8. Despite this the portfolio return showed a negative performance of 0.07%. The standard deviation of the returns is 0.71%. This is around the average level reflects the rather muted performance of returns during the past week. There were no dividends paid during the week from the T20 list. The MNA ETF returned a positive result for the fifth straight week running up a quite impressive 0.34%. The S&P 500 ETF, SPY just failed to recoup the losses sustained earlier in the week to finish slightly down by 0.26%. Without any major news a rather subdued week caused the VIX index to decrease by a further 2.13%.

MNA SPY VIX Returns Table 20190125

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.