This is the analysis of Merger Arbitrage Spread Performance June 16, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 10th – 14th June. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 9th June. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Luxoft Holding (LXFT)

The biggest gainer from the top 20 list of largest cash merger arbitrage spreads this week was Luxoft Holding (LXFT) was up 1.10%. We are extremely pleased with this deal. We posted previously “have taken a position in this stock in the anticipation that the deal will close promptly“. During the week, it was announced that the firms had received all necessary regulatory clearance and the deal promptly closed. Textbook merger arbitraging. Funds have been credited and we search for a new candidate. This is a great example of recent market volatility providing opportunities for investment. The broader market had dragged down the price of LXFT without the deal fundamentals changing. We spotted the opportunity and were able to make a healthy profit with low risk in a short time frame. We sure hope our followers had a similar experience.

Wageworks (WAGE) & Barnes & Noble (BKS)

Now for the reality check. Winners were hard to come by this week. Although two other candidates performed well they were not included in last week’s portfolio because of trading above their current offer prices in the hope of a higher forthcoming offer. Wageworks (WAGE), another unsolicited bid approach, was up this week by 2.41%. Last week we stated, “We try to take advantage of the spread volatility before an agreement is reached“. The stock has continued to move up and has not worked well for our short call position. As previously stated, we managed to hedge half of this position on a slight pull back. We expect to exit the position in the coming week and with a bit of luck we may escape relatively unharmed. Barnes & Noble (BKS), which also trades above its current offer price, was up 1.81% for the week. However, the stock fell 2.60% on Friday as it was announced the company had not received and new higher bids. We expect further news on the deals soon, which will conveyed through our twitter feed.

Spark Therapeutics (ONCE)

Spark Therapeutics was the largest decliner this week falling 10.65%. During the week, it was announced the company had received a second request for information from the FTC. In addition to this, the UK Competition and Markets Authority have launched an investigation. This is not necessarily the death knell for this deal. We suspect the companies will be aware these types of deals could result in a second request. The problem now becomes if the deal completes what will be the expected timeline? The clocks officially begins to tick in the US once the companies have substantially complied with the request for the additional information. Information and analysis is still scarce on this subject so it is difficult to make a judgement. However, penciling in a new completion date of the end of the year still provides an attractive return. We are yet to officially update our analysis on this issue and will await further clarification from the companies. In the meantime, we maintain our small position. We are happy to have stayed disciplined and not increased our holding as the stock dropped. However, this week’s performance has taken the shine off LXFT efforts.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) again found itself amongst the biggest movers for the week. This week the stock finished 3.48% lower at $6.65. Once again, there were no regulatory filings and no new deal news or commentary. This is one of the largest weekly drops we have witnessed in this stock. It seems strange there was no deal news announced. In light of this, we are happy with our long position we have accumulated but may hold off buying at the next level down. At least until some additional clarity is provided in the context of the deal. Should the stock rise however, we will be ready to execute our strategy as previously discussed. For further details, one can simply click the PACB tag at the end of this article for a complete listing of our commentary on this spread.

Mellanox (MLNX)

Mellanox (MLNX) was the third biggest loser this week down 1.42%. The stock now trades at $110.07 against an offer price of $125.00. This spread is now offering 13.56%. There was no deal news announced during the week. However, the large spread does make this deal more exposed to general market volatility. So with a rise in the broader market, why is the spread widening? It was announced that one director is buying 2.2m shares. Obviously a show of great support and not an action that would be undertaken if negative news were on the horizon. We maintain our small position and await further clarity from Chinese authorities.

Portfolio Performance

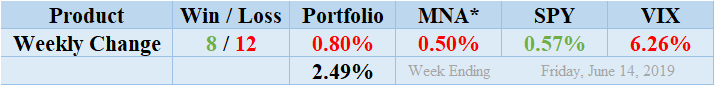

Winners lost out to the losers by a score of 8 to 12 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a negative performance to finish down for the week by 0.80%. As discussed above, the vast majority of this loss is attributable to the decline in ONCE. This has severely widened the spread in ONCE but a second request does not necessarily mean the end of the deal. Readers can stay abreast of the developments in this deal by following our twitter feed or our customised news feed. The standard deviation of the returns for the past week was 2.49%. This is extremely higher than both the recent and longer term averages and caused by the ONCE drop.

MNA SPY VIX Returns Table 20190614

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF continues its run of uncorrelated returns with the broader market. The ETF performance showing a negative 0.50%. The IQ Index merger arbitrage ETF now returns to negative territory since our records began. The losses this week again came from individual target stocks which were not sufficiently hedged. The S&P 500 ETF, SPY spent the week holding on to early gains and by Friday finished up for the week by 0.57%. In accordance with this increase, the VIX index decreased by 6.26%. We continue to expect his level of volatility to continue.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.