This is the weekly analysis of Merger Arbitrage Spread Performance November 17, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 11th – 15th November. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 10th November. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance November 17, 2019

Acacia Communications (ACIA)

Monday morning greeted us with some positive, yet not wholly unexpected news. Acacia Communications announced the German Federal Cartel office had granted regulatory approval for the proposed takeover by Cisco (CSCO). The press release goes on to say,

“This clearance satisfies one of the conditions to the closing of the acquisition, which remains subject to customary closing conditions, including antitrust approval in China. Acacia previously announced that the acquisition had also received regulatory clearance in the United States and Austria. The acquisition is expected to close during the second half of Cisco’s FY2020.”

Looking at previous earnings reports from CSCO, the Q1 earnings period ran until October 26, 2019. Thus, this statement tells us the deal should be completed sometime between late January and late July 2020. We have consistently used an expected completion date of May 31, 2020 as guidance.

As previously stated, this announcement was not completely unexpected as U.S. and Austrian clearance had already been granted. The deal had also cleared HSR back in September. What does stand out however is the ongoing political machinations regarding clearance from the Chinese regulatory authority SAMR. This is inextricably linked to the progress of the U.S. – China trade negotiations.

It is therefore difficult to make a judgement on whether this is a viable merger arbitrage play or not. Risk management is more important than ever in this circumstance. It is up to the individual trader/investor to ascertain how much exposure their personal portfolio has to this unique macroeconomic event. Questions that need to be asked should be similar to

- How many outstanding deals in my portfolio currently require SAMR approval?

- How many deals do I currently hold have a spread larger than ACIA?

- Are there other stocks I hold which will suffer should negotiations stumble or collapse completely?

- What are the combined effects of a trade deal collapse on my portfolio?

This does not pretend to be an exhaustive list but to highlight the need of constant portfolio monitoring when employing this type of event driven investment strategy. Investors more used to a simple buy and hold strategy may not always consider hands-on daily scrutiny as necessary. In addition, following the announcement of this positive news, some traders may become carried away with the likelihood of the deal consummating successfully and become oblivious to the outstanding risks.

In addition to the above press release, during the week the company, via a CT Order, announced

“an extension a previous grant of confidential treatment for information it excluded from the Exhibits to a Form S-1 registration statement filed on December 21, 2015, as amended.”

By the end of the week, the stock had risen 0.98% to close at $67.08. This leaves the simple spread at 4.35%. Using our expected completion date from above (May 31), this gives an annualized return of 8.26%. As can be seen from the graph, the majority of this rise came on Friday, although the stock had traded higher during the week before trending lower. Clearly there are traders prepared to exit their positions at these levels. Unless progress is made soon in the closing of this deal (which may be signified by Friday’s move), we suspect this level of spread may not be sufficient for some arbitrageurs. Hence, our focus on risk management principles at the portfolio level. As we currently have a number of positions with exposure to the trade negotiations, we will be looking to exit or scale back our holding in ACIA during the coming week should no new deal news be forthcoming.

Pattern Energy Group (PEGI)

Pattern Energy Group is a newly annouced deal that makes the best performer list this week. There was no new deal news made since the announcement. Traders can stay abreast of developments in this deal by following our custom deal page for PEGI. The stock closed up for the week by $0.19 at $27.56. With dividends included, this gives a spread of 1.65%.

Fitbit (FIT)

Fitbit was the largest loser this week. Following the deal announcement this stock has trended lower and stands at $6.80. This is down 3.95% for the week. The simple spread is 8.09%. We previously wrote a longer post on seeking alpha as to why we do not like this spread. The issue centered around the possibility of regulatory interference. It appears this analysis was justified and we will await further details of such action before ever initiating a position here.

Changyou.com (CYOU)

Changyou.com was another big loser this week. The stock declined 2.67% to close at $9.47. This leaves the simple spread at 5.60%. There was no new deal news announced during the week. The decline could therefore be attributed to either PEAD, post earnings announcement drift, or fears of a delay in the resolution of the U.S. – China trade deal. We currently do not have a position but may look to initiate one in the coming week at these levels pending any subsequent news announcements.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers was again amongst the largest decliners this week following last week’s disastrous performance. It appears this stock is also suffering from continued negativity surrounding the previously announced less than satisfactory results. Following these numbers the market sis assigning less and less probability that this deal will close successfully. RRGB finished down 2.21% at $26.09, a drop of $0.59. We spoke extensively about RRGB last week. We continue to hold our position.

Merger Arbitrage Portfolio Performance

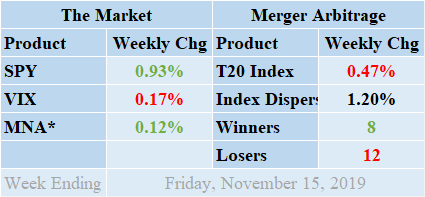

Losers outpaced the winners by 12 to 8 this week with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio continued its run of poor performances by finishing down by 0.47%. This negative performance was primarily attributable to the decline in FIT, CYOU & RRGB. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced dedicated news pages focusing on specific deals such as CISN, FIT, GWR, KEM, ONCE, PEGI, RARX, TIF, WMGI, & ZAYO along with background deal information. Return standard deviation for the past week was 3.71%. This figure is high above both the short-term and long-term averages due to the reason mentioned above.

MNA SPY VIX Returns Table 20191115

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, during a volatile week eventually finished in the black. By Friday, it had produced a positive return of 0.12%. This rise fell significantly short of the rise in the broader market. The broader market posted consistent gains throughout the week as expectations rise of a possible breakthrough in the U.S. – China trade negotiations. This is despite mixed global economic data such as softer Chinese manufacturing and a firmer Eurozone GDP number. The SPDR S&P 500 ETF, SPY, finished up 0.93%. The VIX index unsurprisingly moved lower for the week. It eventually settled on a decrease of 0.17%. Positive sentiment continues to buoy the markets and volatility remains subdued despite the obvious risks to global trade.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.