This is the analysis of Merger Arbitrage Spread Performance September 8, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 3rd – 6th September. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 1st September. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance September 8, 2019

Spark Therapeutics (ONCE)

Spark Therapeutics rebounded strongly this week following recent declines. The company announced an extension to the tender offer. This is now scheduled to close on October 1. However, with the ongoing investigation into the merger it is almost certain this will have to be extended again. The stock closed down another 3.76% at $101.07. Investors may also have been reading positive signals from comments by Roche CEO Severin Schwan who stated,

Ongoing U.S. Federal Trade Commission (FTC) scrutiny of Roche’s $4.3 billion takeover of Spark Therapeutics came as a surprise…It is now expected (to close) by year’s end”

and who went on to say,

We thought we should close this relatively quickly without a more-detailed review. That was not in line with our expectations.”

Although it is quite possible the stock, along with other merger spreads was caught up in the broader market upturn. However, in light of these comments we maintain our position.

Mellanox (MLNX)

Perhaps one of the most positive pieces of news to grace the ears of merger arbitrageurs in recent times came from Mellanox during the past week. On Wednesday, it was announced China’s State Administration for Market Regulation formally started its review of Nvidia’s acquisition of Mellanox. The investigation started last month and has a 180-day review period. This helped lift the stock by 2.38% to $109.60.

In other Mellanox news, the firm is demonstrating its LinkX products as well as showcasing the full line of 100/200/400G cables and transceivers at the China International Optoelectronic Expo (CIOE) September 4th in Shenzhen. We considered the stock had underperformed during the week when considering the scheduling of trade talks between the U.S. and China and the initiation of the investigation. However, once again we maintain our position and will await further clarification in the global trade arena.

Acacia Communications (ACIA)

Acacia Communications was the other significant gainer for the week. The stock rose 2.08% to close at $64.36. This leaves the simple spread at 8.76%. This rise marks a pleasant recovery for this spread. However, as mentioned, the rise in the broader market during the week helped a number of merger arbitrage stocks. As with Spark and Mellanox, we maintain our position and await further clarification in the global trade arena.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) continued its rollercoaster ride this week. The stock finished down $0.44 or 1.31% at $33.05. This leaves a spread of $6.95 against a buyout price of $40. It was a volatile week for RRGB. On Thursday, an announcement read “Red Robin Board of Directors Unanimously Rejects Unsolicited, Conditional Proposal from Vintage Capital”. Surprisingly (to some) the help push the stock higher. Investors cheered the clarification. There was also no immediate response from Vintage Capital suggesting they are not yet prepared to walk away. The statement also went on to say,

The Board and management team also note that they appreciate the constructive dialogue with Vintage, and look forward to future engagement with Vintage and all of the Company’s shareholders as Red Robin continues to focus on driving shareholder value.”

We maintain our position and await further news.

Merge Arbitrage Portfolio Performance

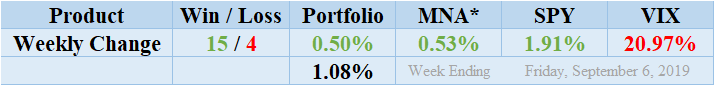

Winners beat out the losers by a score of 15 to 4 with 1 non-mover this week. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance finishing up for the week by 0.50%. As discussed above, the sizeable gains and sheer quantity was enough to overcome the negative effect of RRGB. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed. The latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. Return standard deviation for the past week was 1.08% reflecting in large part the fewer negative movements made. This figure is rather lower than both the long-term and short-term averages.

MNA SPY VIX Returns Table 20190906

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

Gains throughout the week left the MNA ETF producing an overall gain and was left showing another healthy positive return of 0.53%. This now continues a run of positive run where there has been only one negative performances in the last 10 weeks. Finally, the IQ Index merger arbitrage ETF has begun to gain some traction and consistently into positive territory since our records began. The broader market however continues to experience heightened volatility. The S&P 500 ETF, SPY, finished up another healthy 1.91%. The VIX index accordingly moved lower and eventually settled on a decrease 20.97% for the week. We had previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. This week, it was a positive indication with more talks scheduled to take place. Spreads have benefited handsomely but results are yet ot be seen.And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.