This is the analysis of Merger Arbitrage Spread Performance August 18, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 12th – 16th August. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 11th August. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance August 18, 2019

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) had one of its more volatile weeks last week. The stock started brightly but on Tuesday took a nosedive. PACB then recovered throughout the rest of the week to close up 1.41% at $5.76

There was no new deal news announced. However, PACB did announce via the blog section on their website a new preprint that evaluates the “utility of PacBio HiFi reads for assembly of a human genome”. The article is entitled “Improved assembly and variant detection of a haploid human genome using single-molecule, high-fidelity long reads”. For a more comprehensive analysis of this topic, readers are directed to the Genetic Engineering & Biotechnology News website. The study is a follow-up to a recent publication in Nature Biotechnology that introduced a technique to generate sequencing reads with both long read length and high accuracy.

The distinction between long and short reads forms the crux of the CMA investigation announced some weeks earlier. This is a new report and it is difficult to judge how the regulatory authorities will interpret these technological advancements in the marketplace. This highlights one of the major issues in merger arbitrage research. The trader has to very quickly become familiar with a wide range of topics in order to gauge the attractiveness of the deal. In addition to this, such an announcement should have a positive effect on the floor price of the target stock. That is, should the deal fail, the ensuing drop may not be quite as severe as it would have been otherwise. This is sufficient to give us some renewed confidence in this deal.

Should the stock move higher in the coming weeks we will reinitiate our active arbitrage strategy. In the meantime, the simple spread has narrowed to 38.89%.

Cypress Semiconductor (CY)

Cypress semiconductor continued its march upwards during the week. The stock closed 1.23% higher with the spread now standing at 4.83%. There was little news announced during the week other than an amendment to the Definitive Proxy Statement. We maintain our position here and will await further clarification in the global trade arena.

Mellanox (MLNX)

Mellanox was another star performer this week and closed up 0.89%. This was almost entirely due to the rise on Friday and was dragged higher by a recovery in the broader market. The spread now stands at 15.16% and the deal continues to be expected to close by the end of the year. MLNX has been caught up in the throes of the latest US-China trade dispute and it is still difficult to judge what the final outcome of this will be. We maintain our position and will await further clarification in the global trade arena.

Acacia Communications (ACIA)

Acacia Communications was the last winner of note this week. The stock rose 0.65% to close at $63.97. This leaves the spread at 9.43%. This rise marks a stark contrast to last week sharp decline. However, as mentioned, the rise in the broader market towards the end of the week helped a number of merger arbitrage stocks. As with Mellanox, we maintain our position and will await further clarification in the global trade arena.

Red Robin Gourmet Burgers (RRGB)

Red Robin had a horrendous week before it release of Q2 figures next Friday. The stock closed down for the week by 6.34% at $31.61. This was despite a strong recovery on Friday when the stock rebounded 4.32%. From out T20 universe this was the only decliner of note from amongst six that were in the red this past week. There was no new deal news announced which we found strange. Assuming nothing has been leaked with regards to the proposed deal we think this could be related to the changes made to the Board of Directors as announced last week. We are disappointed with the performance of this spread thus far but we maintain our position until further news is made available.

Portfolio Performance

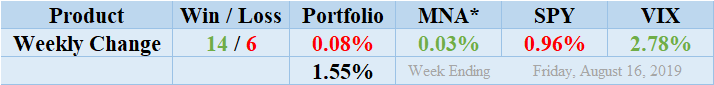

Winners again beat out the losers by a score of 14 to 6 with 2 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. However, the portfolio showed a mildly negative performance finishing down for the week by 0.08%. As discussed above, despite the loss from RRGB a solid performance from the majority of the portfolio was almost sufficient to drag the index back to parity. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 1.55% due in large part to the outsized loss incurred by RRGB. This figure is significantly higher than the long-term average but lower than the figures recored in recent times.

MNA SPY VIX Returns Table 20190816

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF held stead by producing a minor gain to finish up 0.03% for the week. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. We say this almost every week, but it is a fact. Following another volatile week week, the S&P 500 ETF, SPY, finished down by 0.96%. The VIX index accordingly moved higher and eventually settled an an increase 2.78% for the week.

We had previously suggested volatility would remain higher as we continue through earnings season. However, it was the unexpected economic data from China and Germany which prompted this week’s latest bout of volatility. This data has spooked the markets into contemplating the possibility of a global recession. However, strong productivity and retail sales data from the U.S. managed to calm the markets in the latter part of the week. We await to see what bearing this recent data will have on the ongoing China-US trade dispute.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.