This is the analysis of Merger Arbitrage Spread Performance August 11, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 5th – 9th August. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 4th August. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance August 11, 2019

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continued its impressive comeback during the week. The stock was the week’s best performer and finished up an additional 4.60% at $5.68. PACB released a solid set of figures during the week. This is significant despite being in the middle of a takeover as it reinforces the floor price. This is the price to which the stock will revert to should the deal fail. Alternatively, this is the price the stock would have been trading at had no takeover approach ever materialized. For simplicity, we will not discuss the effect of exiting arbs and the supply imbalance following the abandonment of a deal.

However, more importantly was the reiteration by PACB during the announcement of their earnings that both,

“The Company and Illumina (ILMN) expect the Merger to be completed in the fourth quarter of 2019”

This statement comes despite the merger currently being under review by both the FTC and the CMA. We are of course pleased with the recovery in this stock. We maintain our position and will do so until further increases of additional news is released.

Red Robin Gourmet Burgers (RRGB)

Red Robin made a strong recovery from last week’s disappointing performance. The stock was this week’s worst performer. The stock was the only other significant performer for the week and finished up 2.68% at $33.75. This still leaves a spread of 18.52%. Having announced the appointment of three new directors to the board the company ended the announcement with,

“We are confident their experience and expertise will be valuable assets to Red Robin as we execute on our strategic priorities and continue the Board’s efforts to create value for our shareholders.”

In addition to this, there was a number of Form 3 & 4 filings made during the week. This indicating changes and initiations of holding in the stock. We maintain our position in this stock and await further deal announcements.

Acacia Communications (ACIA)

Acacia Communications (ACIA) was by far the worst performer this week decreasing in price by 4.64%. At $63.56, the spread is now 12.73%. Despite a positive earnings beat during the week, the stock declined sharply. The company also announced the date of the special meeting to vote on the proposed takeover as Friday, September 6, 2019. On the negative side, however was a filing of a complaint claiming misleading information in the proxy statement. Although more seriously was the line given in the proxy statement,

“the receipt of certain applicable foreign antitrust approvals, including in Austria, China and Germany”

In light of the reigniting of the US-China trade dispute, we suspect regulatory approval may take longer than first realized. Subsequently the stock has reacted accordingly. As previously stated, we took a position in this stock. Although this may appear to have been a little premature, we are still happy to maintain our position for the time being.

Mellanox (MLNX)

Mellanox again took a tumble during the week. The stock was the second worst performer and finished down 3.47% at $107.58. The spread is now 16.19%. It appears that like ACIA, MLNX has also been caught up in the throes of the latest US-China trade dispute. We maintain our position here and will await further clarification in the global trade arena.

Spark Therapeutics (ONCE)

Spark Therapeutics also announced results during the week. However, a large miss was enough to send the stock down by 0.69% for the week to finish at $100.83 giving a spread of 13.56%. There was no new specific deal news given in the filings. Once again, we will be waiting for a decision from the regulatory authorities regarding this deal. We maintain our position.

Portfolio Performance

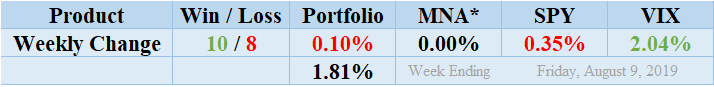

Winners again beat out the losers by a score of 10 to 8 with 2 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. However, the portfolio showed a mildly negative performance finishing down for the week by 0.10%. As discussed above, despite the loss from ACIA the rebounding of PACB was sufficient to drag the index almost back to parity. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 1.81%. This figure is significantly higher than the short and long-term averages and reflects the disparity in return from PACB & ACIA.

MNA SPY VIX Returns Table 20190809

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF held stead by producing a minor loss to finish unchanged for the week. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Following an eventful week, the S&P 500 ETF, SPY, which had retreated sharply from the new highs of last month finished down by a mild 0.35%. The VIX index accordingly rocketed skywards but eventually settled down increasing 2.04% for the week. We had previously suggested volatility would remain higher as we continue through earnings season. However, the ongoing China-US trade dispute continues to catch markets of guard and dominate proceedings although market participants expect both sides to take a breather before initiating any new actions.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.