This is the analysis of Merger Arbitrage Spread Performance June 30, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 24th – 28th June. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 23rd June. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance June 30, 2019

Cypress Semiconductor (CY)

Cypress semiconductor is proving to be a dark horse within the portfolio. Last week it was the best performer and finished up 0.81% at $22.24. The stock went ex-dividend of $0.11 during the week. The spread is now 8.23%. There was little news during the week other than a flurry of filings clarifying the status of employee stock options and a statement in change of beneficial ownership. The previous week saw the acquirer, Infineon (IFNNY), raise 1.5bn Euro to help fund the cost of the acquisition. Although this is another semiconductor, we have taken a positon in this spread. However, we are looking for early closing for this investment to be worthwhile. Currently, official expected closing is early in the new year.

Cray Inc. (CRAY)

Cray Inc. was the only other gainer of note during the past week. The stock rose $0.20 to $34.82 up 0.58%. The spread is now 0.52% against an offer price of $35.00. According to the original press statement,

“the transaction is expected to close by the first quarter of HPE’s fiscal year 2020, subject to regulatory approvals and other customary closing conditions.“

As a guide, Hewlett Packard (HPE) announce Q1 earnings for 2019 on February 21, 2019 for the three months ending January 2019. With such a small spread, it appears the company is well on track to achieve this. We have no position.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continued its downward trend during the week. On Tuesday, the company informed the CMA of the UK that it would not be offering any undertakings that would prevent or delay the referral of the deal to a phase 2 investigation. The stock continued its decline until hitting a low of $5.81 on Thursday. Following the notification on that day that the deal was to be referred, the stock rallied. It closed at $6.05 but still down 2.89% for the week, making it the largest decliner from the Top20 cash spreads.

We believe this deal finally has some clarity. It may make sense for the companies to not have responded at this time to enable them to present a clearer argument later on in the investigation. Initially we expect little stock price movement as news is expected to be scant. Further out, we expect volatility to increase and assist our active arbitrage strategy. Our previous analysis of not adding to our position until further clarity has served us well. We shall now look to add to the position on weakness and continue the strategy as before.

Spark Therapeutics (ONCE)

Spark Therapeutics was the second largest decliner this week losing 2.56% to $102.38. There was no mainstream news for this decline but it does follow last week’s recovery. We suspect traders have taken this opportunity to exit this deal and go elsewhere. A simultaneous investigation by the FTC and the CMA (again) have caused investors to look again at the potential downside of the deal. The stock was trading at around $50 a share before and deal talk began. However, we maintain our small position until further news is available.

Mellanox (MLNX)

Far behind in third place was Mellanox (MLNX), which finished the week down 0.74%. Again, there was little news and it appears investors decided to cut some losses following last week’s rise. The stock traded above $113 last week following the special meeting where shareholders overwhelmingly voted in favor of the deal. We maintain our small position.

WageWorks (WAGE), Barnes & Noble (BKS) & Sotheby’s (BID)

Three deals that have not made the list are WAGE, BKS & BID. They have all been trading over the initial offer price in anticipation of a higher bid. This was confirmed for WAGE with a new higher offer of $51.35. This has proved an expensive gamble for some as the stock previously rose above $53. The stock was down 2.03% for the week. We have previously warned against such speculation. This is a strategy for seasoned market players. However, as demonstrated, some of these professionals have lost some of their investment in this situation. We took a small short position previously and we considered ourselves fortunate to be able to exit at a small profit. This highlights the perils involved in these situations. However, now that the deal is no longer hostile we may look to initiate a position if the stock retreats to the $51.60 level.

The market is also currently expecting higher offers for BKS & BID. However, these stocks finished down 1.62% and 1.34% respectively for the week. We have no plans to initiate position in these stocks.

Portfolio Performance

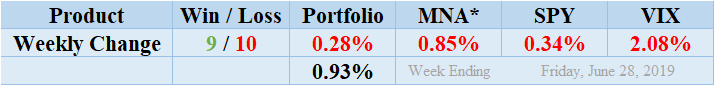

Losers beat out the winners by a score of 10 to 9 with 1 non-mover. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a negative performance finishing down for the week by 0.28%. As discussed above, the vast majority of this loss is attributable to the decline of PACB & ONCE. Investors reason that a second request does not necessarily mean the end of the PACB deal. The delays that may be incurred have caused he spread to widen accordingly. This is a similar situation with ONCE. Readers can stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 0.93%. This is significantly lower than last week but in line with both the recent and longer-term averages.

MNA SPY VIX Returns Table 20190628

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF underperformed the broader market producing a negative return of 0.85%. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Despite Friday’s gains, the S&P 500 ETF, SPY, which fluctuated during the week finished down by 0.34%. The VIX index also decreased during the week by 2.08%. We continue to expect volatility to subside somewhat following any advances in the trade talk between the USA and China.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.