This is the Merger Arbitrage Limited spread performance April 21, 2019 review & analysis. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 15th – 18th April. Investors and traders can follow our latest Top 20 (T20) list each week using the methods described below. The information contained in these weekly lists can be used as a basis for making investment decisions in merger arbitrage. At the end of each week we produce this report which covers the significant movements and any interesting merger arbitrage developments in the takeover targets from the previous week’s list. Click this link for the news and performance analysis from last week.

Specifically, this analysis discusses the biggest winners, losers, portfolio performance and the broader market as a point of comparison. Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 14th April. Regular followers will already be familiar with our rules for inclusion on the T20 list which can be found here.

Winners

- Mellanox (MLNX) was the biggest gainer this week. The stock climbed 0.45% or $0.54 to $119.81. On Tuesday, Mellanox announced their Q1 results beating analysts’ forecasts. No guidance has been given for future earnings due to the merger with after NVIDIA. Although little news was released with regards to the takeover, the solid earnings does reinforce the share price should the proposed merger fail. We have previously taken a small position in MLNX and are happy with our gain thus far. However, following this rise we will begin to look at a possible partial exit. The timeline for this deal is still quite lengthy and a continued rise may provide a decent short term return and provide funds for reinvestment.

- Quantenna Communications (QTNA) was the next best performer coming in a close second with a gain of 0.41% or $0.10. The spread on this arb is now at 0.91% or $0.22. Completion of this deal is officially expected in Q2 of this year. For this reason, the annualised return is not regarded as sufficiently appealing even with an early closing. We do not have any immediate plans to initiate a position in this stock

Losers

- The significant loser this week from the T20 list was Bluegreen Vacations Corporation (BXG). The stock declined by a disastrous 3.12% to close the week at $14.91. During the week BXG announced the confirmation of the next dividend but there were no new filings with regards to the merger. We initiated a small position in this stock during the decline. We may have been a little hasty here but maintain our previous analysis of the actions taken by BASS Pro. Unless there is significant negative news forthcoming we have no intention of exiting this position

- Spark Therapeutics (ONCE) was the second worst performer this week declining an additional 0.45% or $0.50. This continued decline now sees the stock down 2.86% for the last 3 weeks. No new filings were made during the week so the latest news remains with there being only 29.4% of the stock tendered. Roche has extended the offer until May 2nd. The biggest factor now weighing upon this deal is whether or not the FTC will issue a second request.

- Although Redhat (RHT) was the third worst performer this week the stock only declined a mere 0.24% or $0.41. We mention the stock because of IBM’s earning announcement which sent RHT stock up dramatically after hours only to see it decline again the following day. The lackluster results from IBM only increase the importance of securing this acquisition. We have reinitiated a small positon in RHT and believe a timely closure to this deal will reward us handsomely.

Portfolio Performance

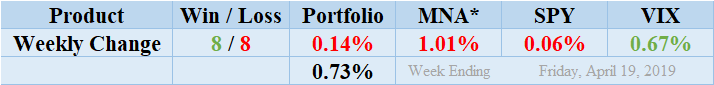

Winners and losers were tied this week with 8 apiece. There were 4 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio posted a slightly negative performance and finished the week down by 0.14%. The loss this week was primarily due to the decline of BXG which fell 3.12%. This continues the fluctuations experienced in recent times by this stock. With little official news regarding the deal last week’s fall may indicate an announcement is due shortly. The standard deviation of the returns is 0.53%. This is reasonably lower than the 3 month average and significantly lower than the 6 month average. There were only one mover from the list with returns greater than 1% reflecting the shortened trading week.

Market Performance

The MNA ETF reversed last week’s positive performance. This time a showing significantly negative 1.01%. This week’s loss takes the MNA performance into negative territory since our analysis began. The loss is primarily due to the ineffective hedging strategy employed by this product. This decline shows the shortcoming of investing in this particular product. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY also showed reflected the morose attitude to the holiday trading week finished down a mere 0.06%. Surprisingly, following the lack of movement in the broader market, the VIX index also increased by 0.67%. Possibly in response to the beginning of earnings season.

MNA SPY VIX Returns Table 20190419

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.