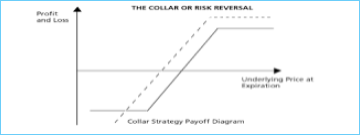

A Risk Reversal is an option strategy that “reverses” the risk of holding a long stock position. Should the the stock price decline, the investor loses money. To address this risk, traders use a Risk Reversal strategy which involves the purchase of an out-of-the-money (OTM) put option financed (usually partially) by the sale of an OTM call option. The put strike (which is below the stock price) and the call strike (which is above the stock price) can be chosen arbitrarily by the trader and can depend on the amount of protection required and the cost of the options. Which in turn is dependent on the implied volatility.

Risk Reversal Volatility Example

If the price of the underlying drops, the put option will increase in value, offsetting the loss in the underlying. If the price of the underlying rises, the underlying position will increase in value but only up to the strike price of the written call option thus limiting the upside. Should the stock not move, the trader will lose any net amount paid to initiate the position. It would be extremely unusual to initiate this position for a credit so receiving premium is unlikely.

This strategy may be of great interest to merger arbitrageurs, especially when earnings announcements or additional corporate events are imminent. The put would protect the downside in the event of a catastrophic loss, such as a deal break, whilst the cost of the put may be offset (partially) by the sale of the call option. This limits the upside, but if no higher bid is expected, it may be a risk the trader is prepared to take. It should be noted however that during this time, implied volatility will be higher thus raising the price of the put option markedly.

Additional Resources

- Often considered obligatory reading for options market-makers is Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd Edition by Sheldon Natenberg

- For more on the topic of volatility, see Kevin Connolly’s book Buying and Selling Volatility