This is the weekly analysis of Merger Arbitrage Spread Performance February 23, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 18th February – 21st February. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 16th February. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance February 23, 2020

Red Robin Gourmet Burgers (RRGB)

Red Robin continues its march forward. In addition to the filing detailing a 1.7% stake accumulated by AllianceBerstein, there were three separate Form 4 filings from senior employees detailing insider purchases. Although the total size of these purchases were not considered significant, it does indicate an increased positive expectation amongst shareholders. Whether the catalyst for this rise is a successful acquisition of the firm, or a successful turnaround plan remains to be seen. Either of these scenarios however will be welcomed by the speculators that have piled into the stock over the recent weeks. The stock closed up for the week by $1.48 at $36.69, a rise of 4.20% leaving the simple spread at 9.02%.

We maintain our analysis that this level appears to be a sweet spot for this merger spread. Whilst broader market volatility can still affect the spread movement, company specific news have driven the stock forward. Our active arbitrage strategy is performing beyond our initial expectations, reaping the benefits of the spread movement. We shall continue in this vein for the foreseeable future.

Instructure (INST)

Instructure made a rare appearance in the largest movers this week. Traders were already aware of the increased offer from Thoma Bravo but it was during the week that the INST board granted its approval of the offer. A tender offer is scheduled to commence by Monday February 24, at the latest. This helped to lift the stock up by $1.17 at $48.83, a rise of 2.45% for the week leaving the simple spread at 0.35%.

INST had traded in the low $50’s during the end of November. Since that time, a great deal of commentary has been ascribed to the possibility of a higher offer forthcoming. Unfortunately for those who bought during this time, that higher offer appears to have topped out at $49. Although we occasionally invest in these types of deal, we rarely speculate on the possibility of higher bids for exactly this reason. We have no position and it is extremely unlikely we shall initiate one in the future.

Mellanox (MLNX)

Another strong performer this week (again) was Mellanox. The stock continued to move higher following NVIDIA (NVDA) strong results last week. The discussions with Chinese regulators are still “progressing” according to NVIDIA which is supporting the share price. The stock gained an additional $1.37 to $122.64. This gives a simple spread of 1.92%.

Kemet (KEM)

Kemet saw declines on Tuesday and Wednesday to become the week’s worst performer. The stock fell $0.19 to close the week at $26.12, or 0.80%. Excluding the quarterly dividends of $0.05, the simple spread has now widened to 4.13%. We have followed KEM for sometime and have indicated before that we would look to take a position on a pull back. With the spread at the level and ISS already advising “Support for the merger is warranted in light of the premium to the unaffected price, the reasonably thorough sale process, and the liquidity and certainty of value inherent in the cash consideration”, this may be our chance. We shall look to open a positon in the coming week.

Merger Arbitrage Portfolio Performance

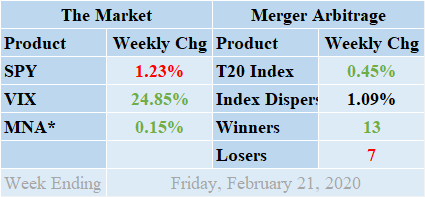

Cash merger arbitrage returns performed well during a week full of positive news. Winners beat out the losers during the previous week by a margin of 13 to 7 with 0 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The merger arbitrage index had a solid daily performance throughout the week. Despite the broader market having already reported the majority of its earnings, there are still a number of cash deal target stocks reporting this week. The index closed on Friday up by a reasonable 0.45% for the week. This gain was attributable to the rise in RRGB and supported by INST. The standard deviation of the individual index returns for the past week was 1.09%. This figure is well below both the historic short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including IOTS, MS-ETFC, RESI, LM & RRGB.

MNA SPY VIX Returns Table 20200221

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, returned to the black this week following last week’s dire performance. What started out as a solid performance for the week was almost shattered on Friday. Posting a loss almost wiping out the entire gains for the previous four days. By the close on Friday, the ETF closed up 0.15%. The broader market itself however, troubled by the possible effects to the global economy by the coronavirus had a volatile week. Despite holding up well until Wednesday, the remainder of the week saw a heavy sell-off with Friday showing unusually large volume. The SPDR S&P 500 ETF, SPY, finished down 1.23%. The VIX index swung sharply higher in response and by Friday had risen 24.85%.

Domestically, news from Apple guiding revenues lower was enough to trouble the markets. Temporary store closures could have a serious knock-on effect to suppliers that might not yet be fully appreciated. In the meantime, the lowering of Chinese rates to support the economy was received well, but does underline just how detrimental the virus outbreak could be to the global economy. Domestically, a surprise contraction in service sectors also helped foster a negative mood surrounding the markets. Still, spreads that have Chinese connections are now strongly supported by higher floor prices making them less immune to potential regulatory issues. As previously stated, this story will continue to unfold, but for the time being domestic market resilience continues to prevail.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.