Hart Scott Rodino HSR Filing

One of the most important facets of merger arbitrage trading is the understanding of the regulatory landscape. A combination of Federal, State or even Local regulations is the largest cause of deal failure. The HSR act is an extremely important piece of legislation covering antitrust and competition law. Even if a merger/takeover if allowed to proceed, delays in regulatory approval may render the investment a losing proposition. It is imperative merger arbitrage traders are aware of these Hart Scott Rodino filing timelines and how they can affect merger arbitrage profitability.

What is the Premerger Notification Program?

The Federal Premerger Notification Program was established by the Hart-Scott-Rodino Act of 1976. The Hart-Scott-Rodino Antitrust Improvements Act of 1976 is also known as the “HSR Act” or Public Law 94-435. This provides the FTC and the Department of Justice with information about large mergers and acquisitions before they occur. Parties proposing certain transactions must submit premerger notification (Hart Scott Rodino Filing) to the FTC and DOJ. Premerger notification involves completing an HSR Form, entitled “Notification and Report Form for Certain Mergers and Acquisitions”. This form contains information about each company’s business. The parties may not close their deal until the appropriate waiting period under the HSR Act passes. This is the most important aspect of the act. In certain circumstances, the government may grant early termination of the waiting period.

Who Needs to File?

Under the HSR Act, the following premerger tests decide whether a premerger filing is necessary.

- The commerce test: Parties to a proposed transaction must already engage in commerce of be involved in any activity that affects commerce.

- The size-of-person test: Refers to whether either the acquirer or target person has total assets or annual net sales of a certain sum.

- The size-of-transaction test: This test is met if a certain amount of assets or voting securities ($15 million as of 2018) is being acquired, or if 15% or more of voting securities are acquired and as a result the acquiring party gains control of an entity with annual net sales or total assets of $25 million or more.

Hart Scott Rodino (HSR) Filing - Document Submission

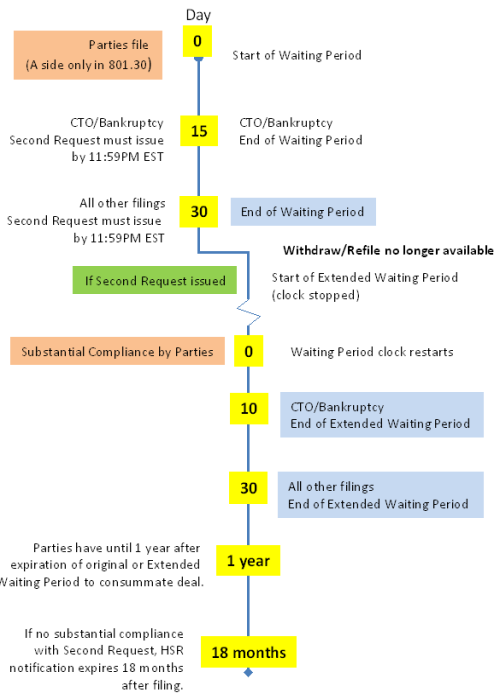

Parties proposing a deal file with both the FTC and DOJ. However, only one antitrust agency will review the proposed merger. Staff from the FTC and DOJ consult and the matter is “cleared” to one agency or the other for review. After the initial filing, the parties then must wait a certain period. This is usually 30 days although only 15 days for all-cash tender offers or bankruptcy sales as highlighted in the image above.

However, during this time, the regulatory agencies may request further information. This is to help them assess whether the proposed transaction violates the antitrust laws of the United States or could cause an anti-competitive effect in the parties’ markets. It is not always clear when the parties make this filing. As a starting point, the trader may estimate 30 (or 15) days in to the future. Clarification, even when requested from the parties is not always forthcoming. If it appears additional information will be required, the parties may delay the filing immediately following the announcement of the deal to enable more time to prepare. If the waiting period expires with no further action from the agency, the parties are free to continue with the merger.

The filing parties may request early termination of the waiting period for a particular transaction. Early terminations notices are publicly available in the Federal Register. They are also available on the Federal Trade Commission website. Merger Arbitrage Limited produces a dedicated page with live updates of all HSR early termination notices. When these are issued, the firms are able to proceed and consummate the deal. Traders are advised to be aware of these updates as the target stock price can be affected dramatically.

Just like a standard review expiry, following the early termination, the parties are now free to proceed with the merger. It is up to the trader to seek out this information. In addition, Merger Arbitrage Limited often highlights such announcements via the @MergeArbLimited twitter feed.

Second Request

If either the FTC or the Antitrust Division has reason to believe the merger will impede competition in a relevant market, they may request more information by way of “Request for Additional Information and Documentary Materials”, more commonly referred to as a “Second Request”. A Second Request extends the waiting period for a specified period. This is typically 30 days (10 days in the case of a cash tender offer or bankruptcy sale), after required parties have substantially complied with the additional request for information.

The additional time provides the reviewing agency with the opportunity to analyze the additionally requested information and take appropriate action if required before the transaction consummates. A typical second request asks to gather information about the sales, facilities, assets, and structure of the businesses that are party to the transaction. This frequently requires a large number of documents. Law firms representing parties to a transaction in with a second request often must hire contract attorneys to review all the documents involved. The agency may also conduct interviews (either informally or by sworn testimony) of company personnel or others with knowledge about the industry.

The Effect of a Second Request on the Merger Arbitrage Spread

A second request may not necessarily mean the end of the proposed transaction. Simply, the agency is saying it needs more information to make a decision. In fact, requests of this nature are increasingly rare. The table below shows the percentage of deals where a second request was issued.

| Year | 2nd Request Deals |

|---|---|

| 2015 | 2.70% |

| 2016 | 3.00% |

| 2017 | 2.60% |

| 2018 | 2.00% |

However, the likelihood of a successful deal outcome falls dramatically. In light of this, the arbitrage spread will widen significantly on the announcement. In addition, traders will be readjusting their expected completion schedules. This extension forces the spread to widen to compensate for the longer holding period. (We discuss the effects on profitability of deal extension in a separate article. In addition, we also produce a list of current merger arbitrage spreads).

Specialist knowledge may often be required to second-guess the intentions of the regulatory bodies. However, traders need to stay aware of industry experts and analysis. Ill-informed stories keen on selling advertising space will only serve as a distraction. This approach will assist greatly in risk sizing a position appropriately that is a potential candidate for a second request.

Following the Second Request

Clearly, the ideal outcome for a trader at the end of the second request review period is the closure of the investigation by the agency. This will allow the deal to proceed. The merger spread will narrow depending on other outstanding closing conditions.

However, in addition to the second request extension, the length of time for this second phase of review may also extend by a given period by agreement between the parties and the government. This is to assist resolving any remaining issues without litigation. If the parties can resolve the issue amicably, there is a higher chance of a successful outcome. This may be the result of a negotiated spinoff to reduce market dominance in a given segment. The timeline however starts to blur. Questions arise such as “How serious is the issue really?” and “Will another extension be necessary?” This all has the effect of extending the closing date and causing the spread to widen further. However, the “paper loss” the trader incurs may improve as negotiations make progress and a sense of clarity of the situation becomes apparent.

The risk posed to the arbitrageur is if the reviewing agency believes that a proposed transaction may violate the antitrust laws. It may then seek an injunction in the federal district court to prohibit consummation of the transaction. This will send the spread into a tailspin as traders rush for the exit. At this point, the spread is already likely to be significantly wide.

Conclusion

We have demonstrated how the HSR filing can have a dramatic effect on merger arbitrage profitability. By understanding the risks involved and being aware of the timelines, traders can adjust their trading to better suit their individual risk budget.

Finding this information useful? Here's what you can do to help...

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

- Sina Weibo

- Twitter etc.

- Follow us on twitter @MergeArbLimited.

- Become friends with us on Facebook

- Register for news alerts and merger arbitrage deal analysis postings via email using the sign up form.

- In addition to these, an RSS feed is also available at the bottom right of the page.

- Contact us using the details given on the Contact Us page.

- Donate using the paypal widget in the sidebar. It’s gladly appreciated and we need the coffee! See the Paypal section for additional incentives

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

Thanks for reading!