The quick ratio, also known as the acid-test ratio, is a measure of how well a company can meet its short-term obligations and financial liabilities with its most liquid assets. In its simplest incarnation, it is calculated as follows

(Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

The ratio indicates the company’s ability to use immediately its cash and cash equivalent assets (assets that can be converted quickly to cash), to pay down its current liabilities. An acid test is a quick and simple test designed to produce instant results. Where as the simplicity of the calculation is a benefit in terms of speed of computation, the limited data in use can give a misleading picture when used against comparison companies.

Quick Ratio in Practice

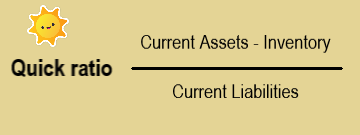

Depending on what information is available, the quick ratio can also be calculated as

(Current assets – Inventory – Prepaid expenses) / Current Liabilities

As expected a single figure for a test of viability for a business entity is not able to give a complete picture of the health of the firm. Some businesses may have large amounts of accounts receivable that are due for payment after an extended period, perhaps 3 or 6 months. If this is coupled with business expenses and accounts payable that are due for immediate payment, the quick ratio will give a false impression. The ratio will look impressive whilst the business is about to run out of cash. On the other hand, fast payments from customers, coupled with extended credit terms from suppliers, may produce a very low quick ratio. This is despite the firm being in a very comfortable position. Traders should be aware of these drawbacks and be able to undertake a more detailed analysis of payables and receivables. This will help produce a figure viable of comparison with company peers. For more accounting metrics please review the EBITDA glossary entry.

Market watchers prefer to see a ratio of 1:1 or higher. However, this figure may vary from industry to industry. A higher ratio indicates greater liquidity, that is, the firm is better able to meet current obligations using liquid assets.