The five forces framework is an industry analytical model developed by Michael E. Porter of Harvard University. This model first appeared in the Harvard Business Review in 1979 and is explained in greater detail in his book Competitive Strategy.

Porter’s model has become a mainstay in academic literature for analyzing competitive situation of a business in a given industry. The framework highlights the five forces that determine the competitive intensity and the attractiveness of an industry in terms of its profitability. Porter refers to these forces as the microenvironment as they are close enough to the company to affect the way in which it serves its customers and makes a profit.

Five Forces Example

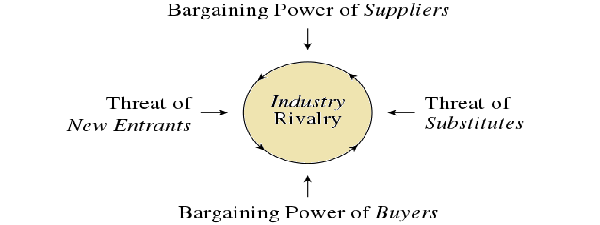

The five forces referred to in the original framework are

- Threat of new entrants

- Threat of substitutes

- Bargaining power of customers

- Bargaining power of suppliers

- Competitive rivalry

The model can be used to analyse the profitability of an industry be those considering making an investment via a merger or acquisition. If the industry is deemed unattractive, then it is one where the forces combine to reduce overall profitability as the industry approaches pure competition. As well as M&A analysts using the model, it is still used widely in academic circles and by private equity firms to assess competitive aspects of an industry.

For example, an industry may have a large number of businesses competing in a given industry. This will increase competition and reduce the power each firm has when dealing with suppliers. Before the industry begins to consolidate as profitability becomes squeezed, analysts may be able to identify opportunities in the supplies space. Entering this area of the supply chain may prove more profitable as there is less competition with a large number of potential clients.

Another use of the framework is to identify industries that are difficult to enter. This may be the healthcare sector where there are stringent Government regulations or possibly the banking industry. Existing businesses try to keep these barriers to entry high so as to reduce competition. This increases the likelihood that a firm wishing to enter the industry will have to do so by way of a takeover. Analysts commonly indirectly use this type of analysis when discussing mergers and acquisitions in a given industry without mentioning it by name.